Saga Memorabilia

Can Memorabilia Be an Investment or Is It Just a Nostalgic Item?

In the world of collecting, memorabilia has gained significant value not only for its ability to evoke memories and emotions but also as a potential investment. Can memorabilia be considered a reliable way to store money, or is it simply a collector’s whim? Below, we explore the different facets of this market and analyze whether investing in memorabilia can truly yield long-term returns.

What Is Memorabilia and Why Does It Attract Investors?

Memorabilia encompasses a wide range of collectible items: from sports, film, music, and art to historical objects that carry significant value for those who own them. What sets memorabilia apart from other types of collectibles is that these objects are deeply connected to events, people, or historical moments of great cultural importance. This gives them not only sentimental value but also perceived value that can increase over time, especially when the items become scarcer or are associated with iconic figures.

Is Memorabilia a Real Investment?

The crucial question is whether memorabilia can be considered an investment—that is, whether it has the potential to generate long-term profit. The answer is: yes, but with some caveats. Although certain memorabilia items have proven to be successful investments—such as a Michael Jordan-signed jersey or an original Star Wars prop—this market is not for every investor and comes with inherent risks.

-

- Rarity and Demand

The key to an item’s appreciation over time is its rarity. Limited or one-of-a-kind objects, especially those linked to iconic moments or influential figures, tend to gain the most value. Demand is equally important. For example, a Diego Maradona-signed jersey can hold immense value due to the player’s popularity and the scarcity of such items. If the object is related to a continuously relevant event or a revered figure, its value may increase.

- Rarity and Demand

-

- History and Culture

Items tied to cult figures or historical moments also have a good chance of increasing in value over time. Memorabilia related to classic movies like Star Wars or music icons like Elvis Presley and The Beatles has shown significant value growth due to pop culture and the lasting impact on generations of fans. The more time passes, the more value an item associated with a culturally significant period can acquire.

- History and Culture

-

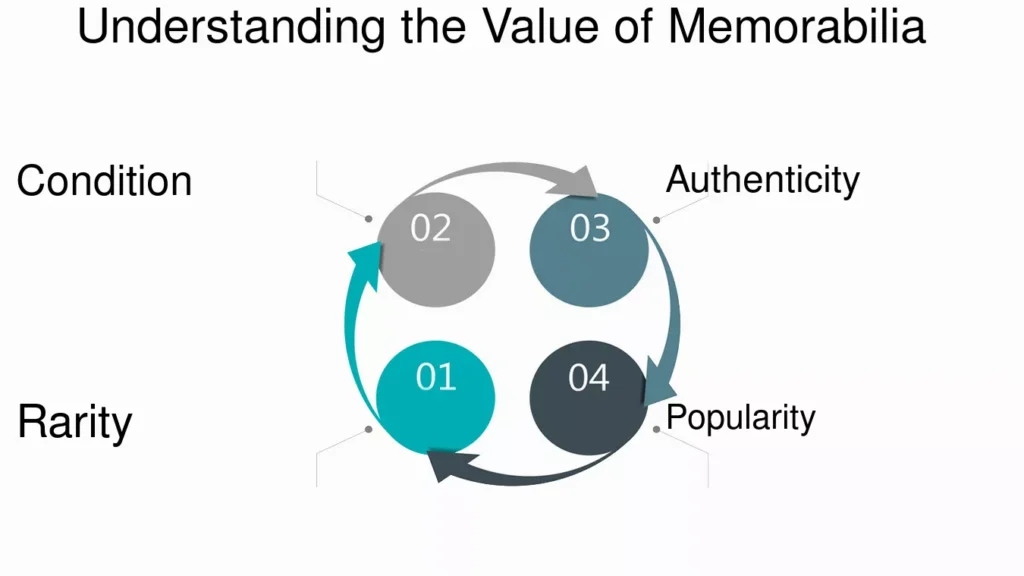

- Condition

The condition of a memorabilia item is another determining factor. An autograph on a well-preserved jersey can be worth much more than one that has faded over time. Items in excellent condition tend to maintain or even appreciate in value, while damaged or deteriorated pieces may decrease in worth. Authenticity is also crucial; items with official certification or verifiable provenance tend to be more valuable than those without it.

- Condition

-

- Market Uncertainty

Although some memorabilia items have gained value over time, the market remains relatively speculative. Unlike more traditional assets, such as real estate or stocks, memorabilia doesn’t always follow a clear pattern of appreciation. Changes in cultural trends, the emergence of new popular figures, or the rise of new interests can affect the demand and value of certain items.

- Market Uncertainty

Success Stories in Memorabilia Investment

There are impressive examples of how memorabilia can be an excellent investment. One of the most emblematic involves sports culture. In auctions, signed jerseys from athletes like Michael Jordan, Muhammad Ali, or Babe Ruth have reached multimillion-dollar prices. For example, a Jordan jersey worn during the 1998 NBA Finals sold for $10.1 million in 2023, setting a record in the sports memorabilia market. Similarly, the film memorabilia market has seen large value increases for iconic items—like Star Wars lightsabers that have sold for over $2 million.

The music market has also had its success stories. Items such as guitars from musicians like Jimi Hendrix or John Lennon, or rare Beatles records, have appreciated notably as collector demand grows.

Is Memorabilia a Good Way to Store Money?

While some memorabilia items have proven profitable, it cannot be considered a safe way to store money, at least not in the same way as more traditional assets. Investing in memorabilia involves a mix of risk, passion, and intuition. If you are a collector with in-depth knowledge of the subject and the ability to identify items with potential value growth, memorabilia can be an excellent addition to your investment portfolio. However, speculation and trends play a significant role, and not all memorabilia items will guarantee consistent appreciation.

The Importance of Research and Diversification

If you decide to enter the memorabilia market with investment in mind, conducting thorough research is essential. Understanding the history behind the items, the related figures, the cultural context, and potential demand is crucial for making informed decisions. Additionally, given that this market is volatile, diversification is key. It’s advisable not to put all your resources into one type of memorabilia but to broaden your investments across different areas, such as sports, film, music, and art.

Conclusion

Memorabilia certainly has the potential to be a profitable investment, but it is not without risk. While certain memorabilia items have yielded impressive returns, the market remains speculative and volatile. If you are passionate about certain types of collectibles and are willing to research and accept certain risks, memorabilia can offer an interesting investment opportunity. However, if your primary goal is to ensure stable growth of your money, it’s important to consider more traditional investment vehicles before committing to this highly specific and exciting market.